Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. However industry averages can form the basis if the business doesnt have a history of uncollectible accounts.

Allowance Method For Uncollectible Accounts Double Entry Bookkeeping

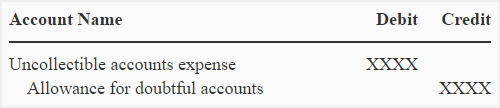

Under this method the uncollectible accounts expense is recognized on the basis of estimates.

Uncollectible accounts expense formula. Usually management use the actual bad debt in the past to estimate the percentage of bad debt in the future. Calculating Uncollectible Accounts Expense. The bad debt expense is then the difference between the calculated allowance for doubtful accounts at the end of the account period and the current allowance for doubtful accounts before adjustment.

Net sales for the year were 250000. Doing so matches the expense to the related sale within the same reporting period. A more conservative approach is to charge an estimated amount to expense when a sale is made.

Bad Debt Expense Formula Percentage of bad debt. The bad debt expense account is debited and the accounts receivable account is credited. When using the allowance for doubtful accounts method an estimate is calculated to record uncollectible accounts expense.

Uncollectible accounts Ending allowance for doubtful accounts textUncollectible accounts textEnding allowance for doubtful accounts - Uncollectible accounts Ending allowance for doubtful accounts. 1 Uncollectible Accounts Expense. While the direct write-off method records the exact amount of uncollectible debts and can be used to write off small amounts it fails to uphold the GAAP principles.

The journal entry to record this is to debit bad debt expense an income statement account and credit allowance for uncollectible accounts a balance sheet contra-asset account for 5000 each. This equals 750 200 1050 1500 and 1350 respectively. The formula for calculating age based accounts collectible technique is.

For example multiply 001 by 75000 002 by 10000 015 by 7000 03 by 5000 and 045 by 3000. The following formula is used to calculate a bad debt expense. The percentage of accounts receivable method formula is as follows.

Uncollectible accounts expense is the charge made to the books when a customer defaults on a payment. Bad debts expense results because a company delivered goods or services on credit and the customer did not pay the amount owed. Bad debt expense is related to a companys current asset accounts receivable.

There is a downside of using this method. Based on previous experience 1 of accounts receivable less than 30 days old will be uncollectible and 4 of those accounts receivable at least 30 days old will be uncollectible. Above we assumed that the allowance for doubtful accounts began with a balance of zero.

This means the total of all individual accounts found in the subsidiary ledger must equal the total balance in accounts receivable. For example if your company and its industry has a long run experience of 02 of credit sales being uncollectible you might enter 02 of each periods credit sales as a debit to Bad Debt Expense and a credit to Allowance for. The allowance method uses an estimate of uncollectible expense also known as bad debts expense and does not predict.

Is the estimation by management which base on history data Accounts Receivable Aging report risk analysis on customers. An aging of accounts receivable results in an estimate of 9000 of uncollectible accounts receivable. There are two general approaches to estimate uncollectible accounts expense.

This expense can be recognized when it is certain that a customer will not pay. While the direct write-off method is simple it is only acceptable in those cases where bad debts are immaterial in amount. Bad debts expense is also referred to as uncollectible accounts expense or doubtful accounts expense.

An account may become uncollectible for many reasons including the debtors bankruptcy. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting ie it recognizes uncollectible accounts expense in the period in which the related sales are made. Accounts uncollectible are loans receivables or other debts that have virtually no chance of being paid.

The debit to bad debts expense would report credit losses of 50000 on the companys June income statement. If instead the allowance for uncollectible accounts began with a balance of 10000 in June we would make the following adjusting entry instead. Historical data typically forms the basis for the estimate.

In the past 3 percent of net sales have proved uncollectible. Multiply each percentage by each portions dollar amount to calculate the amount of each portion you estimate will be uncollectible. BDE S BD Where BDE is the bad debt expense S is the total sales for the accounting period.

Under this method there is no allowance account. In accounting an item is deemed material if it is large enough to affect the judgment of an informed financial statement user. Sales on account are 250000 so the estimate for uncollectible accounts is 5000 250000 x 02.

Multiply each percentage by each portions dollar amount to calculate the amount of each portion you estimate will be uncollectible. This equals 750 200 1050 1500 and 1350 respectively. Accountsreceivable is uncollectible accounts receivable formula known as a control account.

For example multiply 001 by 75000 002 by 10000 015 by 7000 03 by 5000 and 045 by 3000. The offsetting debit is to an expense account. Percentage of bad debt Bad DebtTotal Accounts Receivable.

The Allowance for Uncollectible Accounts has a credit balance of 2000. Heres an example of how this works.