It conducts a physical inventory count and calculates that the actual amount on hand is 950000. Usually a bookkeeper will be entering this information in the general ledgers inventory journals for all of the products that you manufacture if you dont have a bookkeeper generally the owner makes the entries.

Inventory Shrinkage Definition Formula Journal Entries Example

The value of inventory to be written off is.

Inventory shrinkage journal entry. For example if the inventory records of a retailer report that 3261 units of Product X are on hand but a physical count indicates that there are only 3248 units on hand there is an inventory shrinkage of 13 units. The expense account is shrinkage expense for 50000. There can be a number of reasons behind inventory shrinkage like expired products or damaged items.

Inventory shrinkage is the term used to describe the loss of inventory. The last entry in the table below shows a bookkeeping journal entry to record the inventory as it leaves work-in-process and moves to finished goods ready for sale. The common reasons of such difference include inaccurate record keeping normal shrinkage and shoplifting etc.

Inventory Shrinkage Journal Entry. ABC International has 1000000 of inventory listed in its accounting records. In a modern computerized inventory tracking system the system generates most of these transactions for you so the precise nature of the journal entries is not necessarily visible.

It represents the loss of inventory. Periodically weekly monthly etc value the inventory on hand subtract that value from the amount shown in the purchases account and do a journal entry for the answer to the subtraction debit COGS for that value credit purchases for that value. 80000 20000 60000.

However if the difference is significant then it is a cause for concern. Journal entries for inventory transactions December 25 2020 There are a number of inventory journal entries that can be used to document inventory transactions. This rate means that you lost 79 of your inventory value to shrinkage.

Within QuickBooks you dont actually record a formal journal entry like the one shown here. This journal entry debits an appropriate expense account. Inventory Shrinkage Rate 79.

The amount of inventory shrinkage is therefore 50000 1000000 book cost - 950000 actual cost. Debit your Shrinkage Expense account and credit your Inventory account. Both merchandising and manufacturing companies use perpetual inventory system.

The Inventory Shrinkage Accounting Equation The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business. An entry must be made in the general journal at the time of loss to account for the shrinkage. Shrinkage See inventory shrinkage.

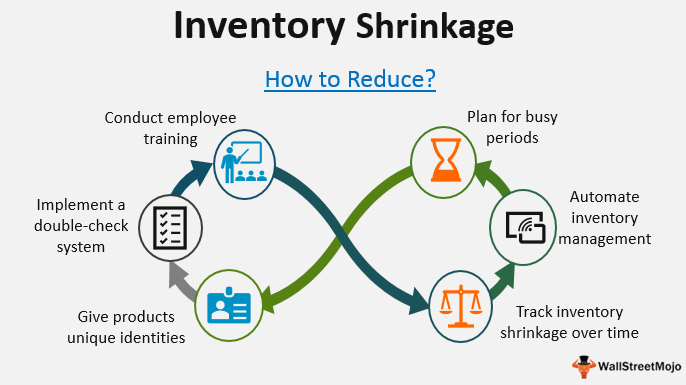

Inventory write-down essentially means to reduce the value of the Inventory due to economic or valuation reasons. You can avoid or lessen inventory shrinkage by taking action. This entry compares the physical count of inventory to the inventory balance on the unadjusted trial balance and adjusts for any difference.

Debit your Inventory account 1000 to increase it. Overview of Adjusting Entry For Inventory Shrinkage When individuals run a business it is very common to lose some inventory during an accounting period. The difference is recorded into cost of goods sold and inventory.

Simple journal entry An accounting entry with only one account being debited and only one account being credited. If a difference is found between the balance in inventory account and a physical count it is corrected by making a suitable journal entry. A journal entry also needs to credit the inventory account for 100.

If you decide to write-off 20000 worth of inventory from the 80000 worth of inventory that your business has at the end of the year you must first credit the inventory account with the value of the write-off to reduce the balance. Inventory purchase journal entry Say you purchase 1000 worth of inventory on credit. Inventory shrinkage is the general term for lost stolen or damaged inventory.

Following is the example of journal entry for an inventory shrinkage that makes for you to record this event. A journal entry also needs to credit the inventory account for 50000. Single-step income statement The income statement format where the operating and nonoperating revenues are grouped and totaled and the operating and nonoperating expenses are grouped and totaled.

Account for the stolen inventory by debiting cost of goods sold for the value of inventory 500 and crediting inventory for the same amount. For this example assume that the inventory shrinkage is 500. Having high levels of inventory shrinkage can be devastating to your companys bottom line.

Then credit your Accounts Payable account to show that you owe 1000. 5 - Cost of goods sold and related items The following. Inventory Shrinkage Rate 0079 X 100.

Divide the difference by the amount in the accounting records to arrive at the inventory shrinkage percentage. Your inventory shrinkage rate is 79. Example of Inventory Shrinkage.

This journal entry debits an appropriate expense account in Journal Entry 9 the expense account is shrinkage expense for 100. The journal entry above reduces the inventory account by 1470 bringing it down to the same value shown by the physical count. This entry compares the physical count of inventory to the inventory balance on the unadjusted trial balance and adjusts for any difference.

The inventory shrinkage percentage is 5 50000 shrinkage 1000000. When the value of the Inventory reduces because of any reason the management has to devalue such Inventory and reduce its reported value from the Balance Sheet. Any business that sells inventory items can encounter shrinkage which can stem from causes such as theft poor.

The periodic inventory methods has TWO additional adjusting entries at the end of the period. Simple regression Regression analysis with only one independent variable.