However writing a hardship letter is the first step to working with your mortgage company so they can help you come to some type of debt resolution. Temporary mortgage relief may be available for people who are experiencing hardship such as job loss income reduction or illness due to COVID-19.

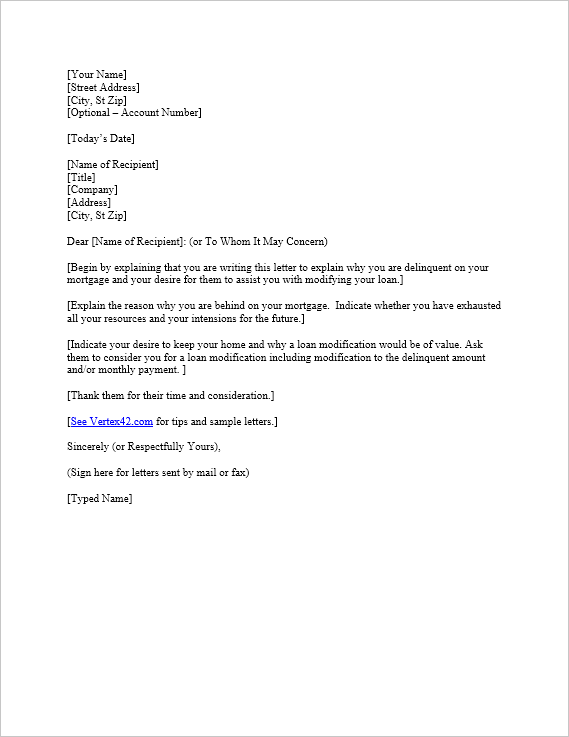

Free Hardship Letter Template Sample Mortgage Hardship Letter

Ryan has been educating consumers about the mortgage process and general finance for almost 20 years.

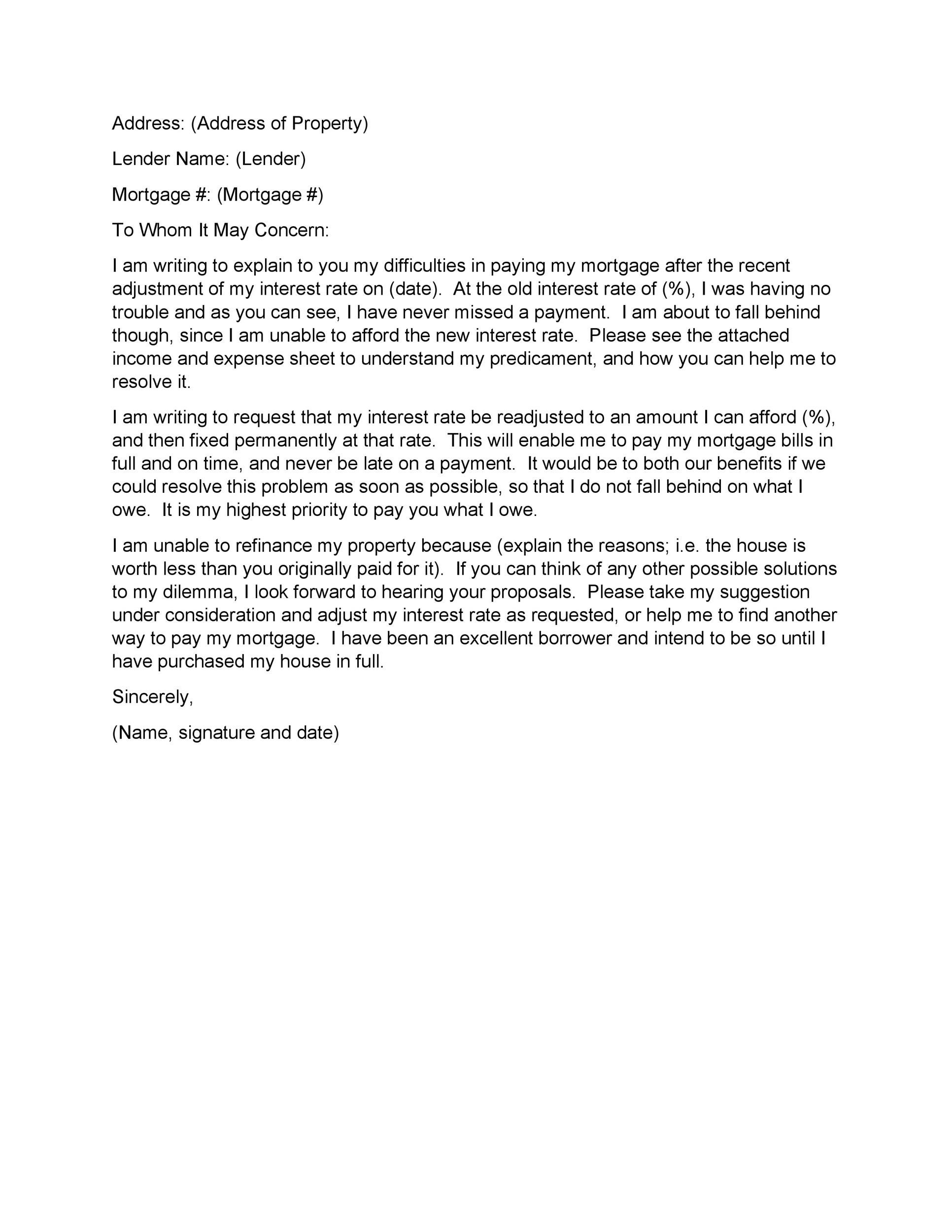

Hardship letter to mortgage company. A commonly used hardship letter a financial hardship letter informs the lender why youre in financial distress and your ability to sort it out. I am writing this letter to explain the reasons why I have or will soon become delinquent on my mortgage payments and to. When applying for a home loan modification a key component of the application is the hardship letter the homeowners description of the financial setbacks theyve experienced that resulted in their inability to pay their monthly mortgage.

This letter is to support our application for a loan modification plan that will help us to get our mortgage payments back on track with an affordable mortgage. If you are looking to request a loan modification your lender will most likely ask you to write a hardship letter. The mortgage hardship letter should have a positive tone that gives the impression that the person is a solid borrower who wants to pay his or her debts and do the right thing.

You may even feel somewhat relieved that youve written your letter and once you. You will most likely have to provide specific information about your financial. Many mortgage companies have updated their online account management to include an option to request mortgage relief with automatic approval for up to three months.

Use this free online tool to generate a hardship letter that you can use to request mortgage forbearance In your letter you should affirm and attest that you are suffering a financial hardship. With both incomes we were able to comfortably cater for a mortgage child care expenses for our lastborn son Madison. A financial hardship letter to mortgage companies or banks is a letter you send to your financial institution explaining why you are no longer able to make the payments on your house and indicate exactly what happened to cause your payments to fall behind.

The reader should easily pick the main reason for your situation when reading the letter. Hardship Letter to Mortgage Company Your Name Your Address Your Phone Your Loan Date To Whom It May Concern. How to write a mortgage hardship letter to a mortgage company.

The reason for the hardship should be stated matter-of-factly. The borrower should clearly state the ways in which. My income has become drastically reduced recently due to sickness death in.

Tips for Writing a Hardship Letter 1. The purpose of the letter is to describe why the borrower may not be able to make their mortgage car loan or other debt payments. Directly copying a letter found online may not convey the right amount of integrity your lender is looking for.

Please keep in mind the sample mortgage hardship letter bellow is only to be used as a guide. These letters are being widely used by investors and homeowners today in order to help them avoid house foreclosure participate in a. Youve decided to ask your lender for a loan modification to.

Writing a hardship letter isnt an easy task and can even take an emotional toll because your home is at stake. Find a hardship letter template to use as a baseline for your own. If you are having trouble making your mortgage payments because of a personal hardship below is a mortgage hardship letter sample you can model.

People use hardship letters for many different reasons but the most common reasons to use this type of hardship letter is requesting a short sale or loan modification to avoid foreclosure. Its crunch time and your mortgage payments have lagged behind. Ryan Baril is the Vice President of CAPITALPlus Mortgage a boutique mortgage origination and underwriting company founded in 2001.

How to Write a Heartfelt Hardship Letter to a Mortgage Company. You must delete any information that is not relevant to your situation and insert your own details where. I am writing this letter to explain the reasons why I have or will soon become delinquent on my mortgage payments and to request that we work together to avoid foreclosure on my home.

Cite the problem that has led to your financial hardship and let the lender understand you are a responsible person and youre willing to resume your payments immediately your. Recognizing eligible hardships Not everything qualifies as a bona fide financial hardship. In the hardship letter you need to offer clear and precise reasons as to why you are unable to service your loan or mortgage.

It is important that you include actual examples of hardship and any plans you have for the future. I am writing this letter to explain the reasons why I have or will soon become delinquent on my mortgage payments and to request that we work together to avoid foreclosure on my home. Due to the death of my husband I have had to support my family with only one stable income of 500000 annually.

-Your Name Your Address Your Phone Your Loan Date To Whom It May Concern. Explain special hardship circumstances. The purpose of a hardship letter is to convey a sense of sincerity honesty and commitment to your lender.

When contacting your mortgage lender about delinquency mortgage by mail the best option is to keep it brief and to the point. We have lived in our home for over 20 years and we want to work hard and keep it. Tell your story briefly but include important points about the hardships you face Our youngest child is.

This is not the place to complain about lifes slings and arrows. This letter intends to inform you of our current financial hardship and to request you for a mortgage modification. This article has been viewed 43783 times.

He graduated from the University of Central Florida in 2012 with a BSBA. You need to prove that you experienced. State The Reason For The Hardship.

My husbands income was an annual 817000. Hardship Letter To Mortgage Company Example Your Name Your Address Your Phone Your Loan Date To Whom It May Concern. In fact even if a foreclosure attorney is representing you.

My income has become drastically reduced recently due to sickness death in the.