Youll be responsible for paying self. If youre not sure where something goes dont worry every expense on here except for meals is deducted at the same rate.

The Federal Tax Forms For A Sole Proprietorship Dummies

If you are the only owner of a limited liability company LLC you are a single-member LLC and you pay income taxes in the same way as a sole proprietor including self-employment taxes explained below.

Sole proprietorship taxes for dummies. This video self employed taxes explained covers everything you need to know about taxes for a sole proprietor. 124 goes t0ward Social Security tax on up to the first 132900 of your income. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation.

In the world of taxation however there are a few unique challenges that a sole proprietorship can face. Youre required to pay estimated taxes on a quarterly basisYou get a free pass for the first year of your business and there are certain other exceptions based on how much you make. Before you file business and personal taxes this year its crucial to understand how Sole Proprietorship taxes work.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. The Tax Cuts and Jobs Act of 2018aka the tax reform billcut the income tax rate to a flat 21 for all businesses that are set up as C corporations. What are the advantages.

Sole proprietors must pay the entire amount themselves although they can deduct half of the cost. Disposed of a capital property or had a taxable capital gain in the year. Not Paying Your Quarterly Taxes.

Sole proprietors must remember to set money aside for tax payments which are usually paid according to a quarterly schedule. A sole proprietorship is the simplest most common way of organizing a business. As a sole proprietor in self-employment you own an unincorporated business.

For legal purposes there is no distinction between the business and the sole proprietor. Other types of entities C corporations S corporations partnerships and limited liability companies LLC also claim similar write-offs although some entities have slightly different rules. This means you contract your services and skills out to entities or via freelance.

Sole proprietors must also pay the so-called self-employment tax which means paying both the employee and the employer sides of Social Security and Medicare. This applies to spouses too so if your spouse or common-law partner is self-employed you also have until June 15 th to file. Additionally sole proprietorships need to account for the portion of their Social Security and Medicare contributions that would otherwise be withheld and paid for by an employer.

Our top 25 list is based on IRS data showing the write-offs commonly taken on sole proprietorship returns using a Schedule C. If you are a sole proprietor you or your authorized representative have to file a T1 return if you. Heres how the self-employment tax breaks down for 2019.

Payment of taxes on business income. As a sole proprietor you tend to make your own path when it comes to how you run your business. But theres one more thing.

Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed. Self Employed Sole Proprietors Partners If you have received full-time or part-time income from trade business vocation or profession you are considered a self-employed person. A sole proprietorship automatically exists whenever you engage in business by and for yourself without partners and without the protection of an LLC corporation or limited partnership.

Although it sounds fancy and complicated forming a sole proprietorship is about as easy as it gets. Have to pay tax for the year. However note that the payment due date for any balances owing on your income tax was April 30th.

Thats a total of 153 percent or double what an employee would normally pay and its a bummer for sole proprietors. Try your best to fill this out. A sole proprietorship is not a separate legal entity.

For businesses including sole proprietors tax time isnt just once a year. You are the boss and totally responsible for everything that happens. Whether your company will be a sole proprietorship an LLC a partnership an S-corporation or C-corporation will affect how your taxable income flows through to your personal tax return.

We cover what you need to do as a self employe. For tax purposes a sole proprietorship is considered a pass-through businesses meaning that the profits or losses of the business pass through to the owners personal tax return. You have to report this income in your tax return.

One common form of self-employment is working as an independent contractor. A sole proprietor is someone who owns an unincorporated business by himself or herself. A sole proprietor pays taxes by reporting income or loss on a T1 income tax and benefit return.

Self-employed people such as sole proprietors have until June 15th to file their income tax. The self-employment tax rate is 153 which consists of 124 for Social Security up to an annual income ceiling above which no tax applies and 29 for Medicare with no income limit or ceiling. A business where you are the only owner.

Sole Proprietor Tax Mistakes 1. If youre used to working for an employer that withholds a portion of your paycheck each period paying taxes as a sole proprietor or a freelancer can be daunting. If you operate your business or LLC as a corporation then you are not a sole proprietor.

It is a business owned and run by one person hence the term sole. The income tax rate for sole proprietorship firm is the same as that of the income tax rate of individuals. If youre a sole proprietor whos completely self-employed youre responsible for paying this sole proprietor tax yourself.

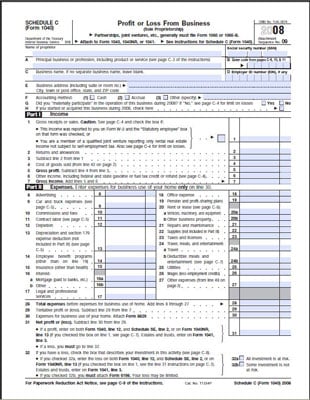

Forming a sole proprietorship When you begin transacting business be it. In Budget 2020 a new tax regime has been announced where the individuals shall have the option to pay taxes as per the new slabs subject to certain conditions from FY 2020-21 onwards. If you are a sole proprietor your business income and expenses should be reported on Schedule C.