Recently accounting standards started requiring companies and businesses to show operating leases on their Balance Sheet. Find out when date of the change is and whether and organisation of your size will be affected.

Impact Of Operating Leases Moving To Balance Sheet

Record the amount as a debit to the appropriate fixed asset account and a credit to the capital lease liability account.

How to record a capital lease on the balance sheet. Capitalizing an Operating Lease If a lease does not meet any of the above criteria it is considered an operating lease. In years gone by operating leases were disclosed as off balance sheet commitments with only the annual lease expenses recognised. The liabilities that they owe over the life of the lease is also recorded operating lease liabilities.

The new leasing standard IFRS 16 Leases will introduce a fundamental change to traditional operating lease accounting requiring lessees to capitalise leases on the balance sheet. The leased asset and lease obligation are shown on the balance sheet. The asset column should have an entry titled Auto Lease if an auto was the leased item or Lease Purchase.

The new leasing standard released by IASB removes the distinction between finance and operating leases for lessees. As we have already calculated under the capital lease criteria test our present value is 1033238. Now that the lease is recognized on the balance sheet you must account for the rental payments.

These figures must reconcile. The capital lease accounting journal entries are in three parts. Paragraph 209 of FRS 102 requires a lessee to recognise a finance lease in the balance sheet at an amount equivalent to the fair value of the leased asset or if lower the present value of the minimum lease payments determined at the start of the lease.

Figure accumulated depreciation by multiplying the monthly amount of 26701 by three months October November and December. Unlike operating leases that do not affect a companys balance sheet capital leases can have an impact on companies financial statements influencing interest expense depreciation expense. On January 1 each year you must make a payment to recognize your lease payments to the lessor.

In the balance sheet the present market value of the leased asset comes under the asset side. For lessees all leases will be recorded on the balance sheet as liabilities at the present value of the future lease payments along with an asset reflecting the right to use the asset over the lease term. To record the periodic depreciation charge.

Because the company isnt paying these expenses for nothing they get benefit from them and record them as assets on the balance sheet operating lease right-of-use assets. Debit the asset column on the balance sheet for the lease purchase price if you are recording a capital lease transaction. For example if the present value of all lease payments for a production machine is 100000 record it as a debit of 100000 to the production equipment account and a credit of 100000 to the capital lease liability account.

Under a capital lease the lessee is considered an owner and can claim depreciation and interest expense for tax purposes. To record the periodic rental payments to clear the principal and to charge the profit and loss account with the interest. Capital lease refers to a type of lease where all the rights related to the assets are transferred to the lessee and lessor only finance the asset.

Steps to Capital Lease Accounting. Following the principle of substance over form assets are recorded in books of the lessee as fixed assets. We should follow certain steps one by one to accurately account for the capital lease.

Following is a partial balance sheet reflecting the lease transaction. To record the effective purchase of an asset using a loan. Typically these leases are in relation to property plant and equipment PPE so the capital lease assets were recorded in PPE while the lease liabilities were recorded in debt or other liabilities.

With capital leases you record the asset on the balance sheet and record related operating expenses to your expense sheet. It provides guidelines on how the capital lease asset should be recorded by the business in its balance sheet income statement and cash flows. To do this you would debit Lease Payable for 12000 and credit Cash for 12000.

Next well have to record the lease asset. Record the journal entry to recognize each rental payment. A capital lease referred to as a finance lease under ASC 842 and IFRS 16 is a lease that has the characteristics of an owned asset.

For instance if an asset costs 100000 no salvage value and useful life of ten years then the annual depreciation on Straight-line basis will be 10000. Contract hire operating leases have traditionally kept cars and vans off balance sheet but new IFRS 16 rules from the IASB mean certain businesses will need to account for leasing ON balance sheet. They also state that companies must record a liability for operating leases with a corresponding asset known as the Right of Use assets on their Balance Sheets.

Pull the numbers for the liabilities from the lease amortization schedule. Under a capital lease the lessee must record the depreciation in a usual way. Once we have gathered our information ie we know the lease term the lease payment and the discount rate we simply discount the liability over the lease term using the discount rate.

In accounting for a capital lease the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor. We then record the lease liability or the resulting amount on the balance sheet. Prior to this new accounting standard GAAP required the assets and liabilities associated with capital leases to be on a companys balance sheet.

With operating leases you only record each lease payment as an operating expense and you dont include the asset on the balance sheet.

Now lets understand these steps and accounting entries with an example. Unlike operating leases that do not affect a companys balance sheet capital.

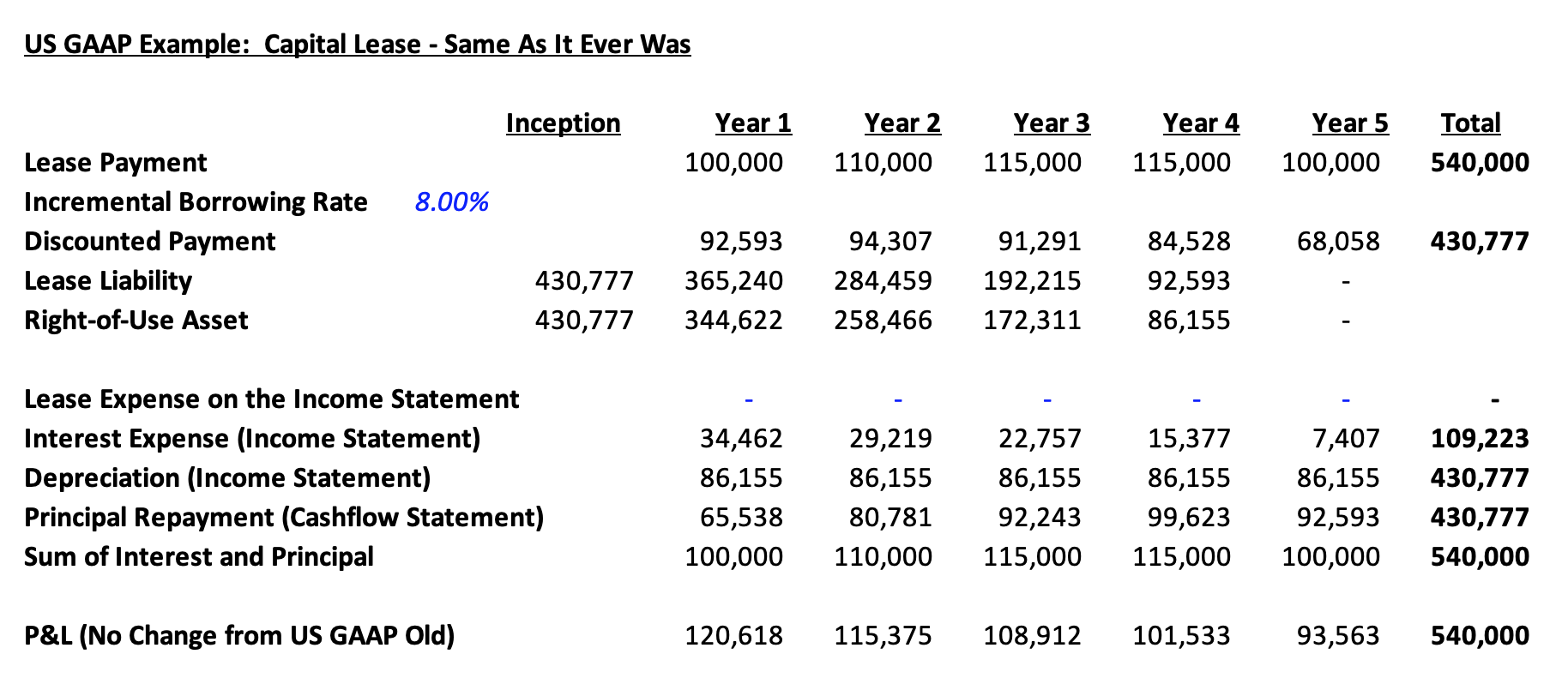

Accounting For Leases The Marquee Group

As a refresher an operating lease functions much like a traditional lease.

Capital lease balance sheet example. Balance Sheet Template This balance sheet template provides you with a foundation to build your own companys financial statement showing the total assets liabilities and shareholders equity. Using the old lease standard we would record the asset for example a truck directly on the balance sheet. Lease accounting is an important accounting section as it differs depending on the end user.

For example if the present value of all lease payments for a production machine is 100000 record it as a debit of 100000 to the production equipment account and a credit of 100000 to the capital lease liability account. Leases must be accounted for on-balance sheet In accounting terms a lease is a contract or part of a contract that conveys the right to control the use of an asset for a period of time. The value of machinery is 11000 and useful life is 7 years.

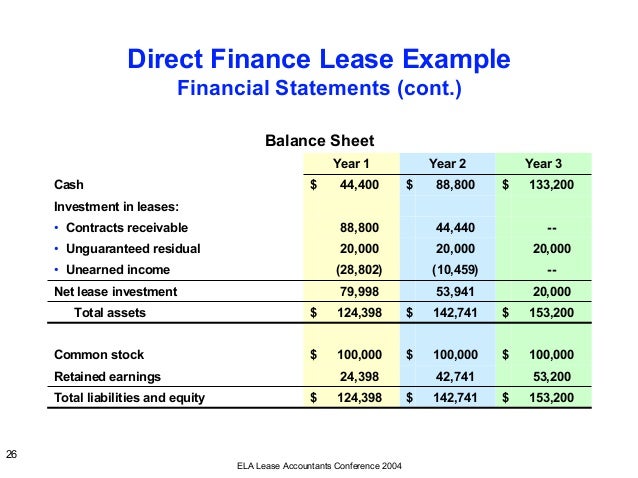

The accounting and reporting of the lease in different ways has varying effects on financial statements and ratios. Assets Liabilities Equity Using this template you can add and remove line items under ea. A simple analogy is taking out a loan.

A lessor is the owner of the asset and a lessee uses the leased asset by paying periodically to the lessor. Figure accumulated depreciation by multiplying the monthly amount of 26701 by three months October November and December. A depreciating asset and an amortizing liability are recognized on the balance sheet.

A company can lease assets in one of two ways. The monthly lease payment at the end of each month is 200. Capital Lease Accounting Example Suppose a business enters into a capital lease agreement for an asset worth 12000 and agrees to pay a deposit of 1500 leaving a balance of 10500 to be financed by a capital lease with an implicit annual interest rate of 7 requiring a further four annual rental payments of 3100.

What is a capitalfinance lease. Recording capital leases on the balance sheet under ASC 840 We cover this topic in full detail and with a comprehensive example on our blog Capital Lease Accounting and Finance Lease Accounting. In short capital leases which are now classified as finance leases under ASC 842 were treated like financed purchases.

Lets say that Company A entered into a capital lease contract to lease out an airplane with Company B on January 1 2018. A capital lease referred to as a finance lease under ASC 842 and IFRS 16 is a lease that has the characteristics of an owned asset. Finance lease expenses are allocated between interest expense and principal value much like a bond or loan.

Typical types of leases in the NHS include those for equipment vehicles and property. Even though a capital lease is a rental agreement GAAP views it as a purchase of assets if certain criteria are met. A capital lease in contrast to an operating lease is treated as a purchase from the standpoint of the person who is leasing and as a loan from the standpoint of the person who is offering the lease for accounting purposes.

As a consequence working capital stays the same but the debtequity ratio increases creating additional leverage. The lease term was for 6 years and the interest rate stood 12. Following is a partial balance sheet reflecting the lease transaction.

And the asset will mostly stand in the balance sheet either fully depreciated or with a nominal depreciated value. Record the amount as a debit to the appropriate fixed asset account and a credit to the capital lease liability account. As a simple example a company taking out a 20 year lease at an annual rental of 1 million with no break clauses and an illustrative incremental borrowing rate of 6 will recognise a right to use asset ignoring related costs and a matching financial liability of 115 million being the discounted value at 6 pa of future lease payments.

Operating Leases Remember that in basic accounting assets and liabilities must reconcile. A capital lease is a lease of business equipment that represents ownership and is reflected on the companys balance sheet as an asset. Now we are recording the right to use the asset for example the right to use a truck instead of the actual asset itself.

In accounting for a capital lease the lessee records the leased asset as if he or she purchased the leased asset using funding provided by the lessor. Capital leases or operating leases. Since a finance lease is capitalized both assets and liabilities in the balance sheet increase.

The right-of-use asset is an intangible asset. Therefore in a statement of cash flows part of the. Pass the journal entries in books.

The asset depreciates straight line over the term of the lease. If you have the option to purchase the leased item for a small fee at the end of the lease then you have a capital lease and this will be recorded differently on the balance sheet than an operating lease where you dont have a purchase option -- for instance with rented office space. A lessee and a lessor report and account the leases differently.

As an example if a company takes out debt they get the cash from the debt as an asset and the new debt as a liability. The balance sheet is based on the fundamental equation. For leases whether financial or operating the assets and liabilities also reconcile.

When leasing an asset it is recognized on the balance sheet at the present value of the future lease payments usually measured at the companys incremental borrowing cost. Example Capital Lease Accounting. Pull the numbers for the liabilities from the lease amortization schedule.

The scrap value of the asset at the end of useful life is nil. Capital leases effectively act as debt to own the underlying asset leased.