Instead go to Corporations. More on self employment tax for dummies.

Self Employed Taxes For Dummies Everything You Need To Know About Filing Scrubbed

Self-employed individuals generally must pay self-employment tax SE tax as well as income tax.

Self employed taxes for dummies. Here is the ultimate step by step guide for self employment tax for dummies. However self-employed people can also offset some of their expenditure against tax. Which Business Types Pay Self-Employment Taxes.

If you are a recently self-employed Canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. How to Avoid Self-Employment Taxes. The self-employment tax rate for 2019 is 153 which encompasses the 124 Social Security tax and the 29 Medicare tax.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. This means that they can reduce their taxable income by deducting certain expenses from it. The reality is being self-employed can be awesome for 11 months out of the year and.

If you are incorporated this information does not apply to you. So say that you are in the bottom income bracket the 10 bracket. As a self-employed worker you can take some special deductions that will reduce your tax burden.

Employees pay similar taxes through employer withholding and employers must make additional tax contributions on behalf of each employee. Now You Know How to File for It. Free to sleep in until 11 am free to work while your adorable toddler plays at your feet free to.

As if that wasnt bad enough this is also not including what you have to pay based on your marginal tax bracket. Terms and conditions may vary and are subject to change without notice. The business owner calculates their share of net income income minus expense deductions from the business for.

You will need to pay 153 of your earnings in taxes during each quarterly period. Self-employment tax applies to your net earnings. Self-employed people are both the employer and the employee.

These account for both employer and employee portion of social security and medicare taxes in the amount of 153. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Therefore they pay both halves of the Social Security and Medicare contributions called self-employed tax or SE tax which totals.

The checklist provides important tax information. Self-Employed Taxes for Dummies. Self-employed individuals including those earning income from commissions.

When filing your annual tax return include an IRS Form SE to show the IRS how much self-employment tax you were required to pay for the year. These taxes are separate from your income tax. In general anytime the wording self-employment tax is used it only refers to Social Security and Medicare taxes and not any other tax like income tax.

Self Employed Tax. If you are starting a small business see the Checklist for new small businesses. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Self-employment tax SE tax has two parts. If you are self-employed you will probably owe self-employed taxes. Self-employment taxes exist solely to fund the Social Security and Medicare programs.

Self-employed people generally must make estimated tax payments if they expect to owe taxes of 1000 or more when they file the return. If you elect partnership taxation for your limited liability company LLC youre assessed a 153 percent self-employment tax in addition to the personal income taxes youre required to pay on the profit thats allocated to you. You can then apply the self-employment tax rate of 153 to this.

Self-employment tax is a tax on the net income of a self-employed individual. Half of your self-employed taxes are tax-deductible because thats the employer portion of your tax obligations. The current self-employment tax rate is 124 for Social Security which is your old-age survivors and disability insurance and 29 for Medicare which is your hospital insurance.

Keep really good records of all your expenses for your taxes. Any dollar you make from self-employment results in a tax bill of 253 yes ONE-FOURTH of your net income. This tax is a huge 153 of your net income for the year.

My TOP 10 self employment and small business tips. Now that you have read our self-employed taxes for dummies guide you now know how to prepare and file for it. The self-employed are required to pay all of these taxes themselves.

Whats new for small businesses and self. As a quick reminder folks who work for themselves need to pay both income tax and self-employment tax because a sole-proprietor is both the employer and the employee so get taxed from both ends. If you dont want a nasty surprise the surprise being a giant tax bill once a year for your unpaid taxes following the quarterly payment plan will help you keep better track of your self-employment taxes.

Aside from the extra info youll include on your tax return you might also be required to register for a GSTHST account and become a GSTHST Registrant. All of these businesses are considered pass-through entities because the profits and losses of the business pass through to the owners on their personal tax returns. For earnings above 150000 the rate is 45 per cent for both the 2019-20 and 2020-21 tax years.

Self-employment tax is due on the income of all small businesses. Social Security and Medicare which together take about 153 percent of your earnings.

Youll be responsible for paying self. If youre not sure where something goes dont worry every expense on here except for meals is deducted at the same rate.

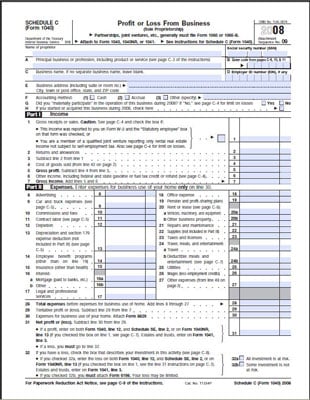

The Federal Tax Forms For A Sole Proprietorship Dummies

If you are the only owner of a limited liability company LLC you are a single-member LLC and you pay income taxes in the same way as a sole proprietor including self-employment taxes explained below.

Sole proprietorship taxes for dummies. This video self employed taxes explained covers everything you need to know about taxes for a sole proprietor. 124 goes t0ward Social Security tax on up to the first 132900 of your income. However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation.

In the world of taxation however there are a few unique challenges that a sole proprietorship can face. Youre required to pay estimated taxes on a quarterly basisYou get a free pass for the first year of your business and there are certain other exceptions based on how much you make. Before you file business and personal taxes this year its crucial to understand how Sole Proprietorship taxes work.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. The Tax Cuts and Jobs Act of 2018aka the tax reform billcut the income tax rate to a flat 21 for all businesses that are set up as C corporations. What are the advantages.

Sole proprietors must pay the entire amount themselves although they can deduct half of the cost. Disposed of a capital property or had a taxable capital gain in the year. Not Paying Your Quarterly Taxes.

Sole proprietors must remember to set money aside for tax payments which are usually paid according to a quarterly schedule. A sole proprietorship is the simplest most common way of organizing a business. As a sole proprietor in self-employment you own an unincorporated business.

For legal purposes there is no distinction between the business and the sole proprietor. Other types of entities C corporations S corporations partnerships and limited liability companies LLC also claim similar write-offs although some entities have slightly different rules. This means you contract your services and skills out to entities or via freelance.

Sole proprietors must also pay the so-called self-employment tax which means paying both the employee and the employer sides of Social Security and Medicare. This applies to spouses too so if your spouse or common-law partner is self-employed you also have until June 15 th to file. Additionally sole proprietorships need to account for the portion of their Social Security and Medicare contributions that would otherwise be withheld and paid for by an employer.

Our top 25 list is based on IRS data showing the write-offs commonly taken on sole proprietorship returns using a Schedule C. If you are a sole proprietor you or your authorized representative have to file a T1 return if you. Heres how the self-employment tax breaks down for 2019.

Payment of taxes on business income. As a sole proprietor you tend to make your own path when it comes to how you run your business. But theres one more thing.

Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed. Self Employed Sole Proprietors Partners If you have received full-time or part-time income from trade business vocation or profession you are considered a self-employed person. A sole proprietorship automatically exists whenever you engage in business by and for yourself without partners and without the protection of an LLC corporation or limited partnership.

Although it sounds fancy and complicated forming a sole proprietorship is about as easy as it gets. Have to pay tax for the year. However note that the payment due date for any balances owing on your income tax was April 30th.

Thats a total of 153 percent or double what an employee would normally pay and its a bummer for sole proprietors. Try your best to fill this out. A sole proprietorship is not a separate legal entity.

For businesses including sole proprietors tax time isnt just once a year. You are the boss and totally responsible for everything that happens. Whether your company will be a sole proprietorship an LLC a partnership an S-corporation or C-corporation will affect how your taxable income flows through to your personal tax return.

We cover what you need to do as a self employe. For tax purposes a sole proprietorship is considered a pass-through businesses meaning that the profits or losses of the business pass through to the owners personal tax return. You have to report this income in your tax return.

One common form of self-employment is working as an independent contractor. A sole proprietor is someone who owns an unincorporated business by himself or herself. A sole proprietor pays taxes by reporting income or loss on a T1 income tax and benefit return.

Self-employed people such as sole proprietors have until June 15th to file their income tax. The self-employment tax rate is 153 which consists of 124 for Social Security up to an annual income ceiling above which no tax applies and 29 for Medicare with no income limit or ceiling. A business where you are the only owner.

Sole Proprietor Tax Mistakes 1. If youre used to working for an employer that withholds a portion of your paycheck each period paying taxes as a sole proprietor or a freelancer can be daunting. If you operate your business or LLC as a corporation then you are not a sole proprietor.

It is a business owned and run by one person hence the term sole. The income tax rate for sole proprietorship firm is the same as that of the income tax rate of individuals. If youre a sole proprietor whos completely self-employed youre responsible for paying this sole proprietor tax yourself.

Forming a sole proprietorship When you begin transacting business be it. In Budget 2020 a new tax regime has been announced where the individuals shall have the option to pay taxes as per the new slabs subject to certain conditions from FY 2020-21 onwards. If you are a sole proprietor your business income and expenses should be reported on Schedule C.

All S corporations start out as regular corporations. The S Corporation doesnt pay taxes at the corporate level and the business owner gets to avoid self-employment taxes.

5 Advantages Of S Corporations Infographic The Incorporators

CPA and tax professor answers dozens of common S Corporation questions in easy-to-understand language.

S corporation taxes for dummies. How to File S Corporation Taxes. Its why the very richest wealthiest and most powerful people all own and control mighty corporations. Resource Center Starting a Business.

This is done by filing an S Election Form 2553 with the IRS within a few months of the corporations formation. An S-corp typically has employees and this requires running payroll and filing payroll tax returns including Form 940 and Form 941. Its also why they are often for the very purposes of tax on cleaner salaries within the company books.

Instead the shareholders of the S corporation include the profit on their returns. Obtaining pass-through taxation corporation style S corporation. An S corporation must file Form 1120S including Schedule K-1.

Federal taxes for corporations differ depending on whether you have an S corporation or a C corporation. 1 S Corporation earns 1m. The S Corporation is a powerful tool to help small business owners form a corporation that allows a lower level of risk and that doesnt have the drawback of a double tax on business profits.

If youre a C corporation considering an S corporation election by the way youll want to get a competent tax practitioner involved in your analysis and decision-making. An S corporation is formed only when a regular corporation elects a special small-business tax status with the IRS. S corps are pass-through tax entities.

Nelson has also taught LLC and S corporation taxation in the graduate tax school at Golden Gate University. 2 Each of 4 partners owns 25 3 Each partner pays tax on 250000 in profits 1m x 025 4 Distributions have nothing to do with taxation. S Corporations Explained.

Pass-through tax treatment as noted above the profits and losses of an S corporation flow directly through the corporate entity to the individual shareholders which is often desirable. The S corp tax designation allows corporations to avoid double taxation. This deduction is in addition to the normal business expense deductions the S corporation can use to reduce its taxes The QBI deduction is taken off.

That means if an S-corporation owns shares of stock in a C-corp which then distributes dividends to the S-corp as a shareholder the S-corp cannot receive a tax deduction like. The S corporation allows for limited liability and a single layer of taxation for small closely held businesses according to a House Subcommittee report in 2006. Forming an S-Corporation can help the shareholders save money on taxes but there are disadvantages as well.

An S-corporation doesnt pay income tax but it must set aside 22 million of taxable income among the owners in an equal proportion of the number of stocks that each owner has. Like other pass-through businesses S corporation owners may be eligible to take a Qualified Business Income Deduction QBI to deduct up to 20 of their business income with certain qualifications. S-Corporation Advantages and Disadvantages.

Because of the 153 percent tax on dividends some companies opt to wait until they generate more income to make the change to S corporation worthwhile. If two shareholders equally own an S corporation that makes 100000 for example each shareholder adds 50000 of income to his or her return and then pays the tax on that 50000 profit from the S Corporation. However S corporation owners are required to pay themselves a reasonable salary which means you cant call all profits dividends to avoid any taxes.

An S-corporation can own 80 of the stock of a C-corporation but unlike a C-corporation an S corporation is not eligible for a dividends received deduction DRD. And QuickBooks for Dummies. It should be noted that the IRS does watch an S Corporation closely to make sure that the salaries are reasonable and fair.

S Corporation vs Default LLC. In effect the built-in gain tax prevents C corporations from saving income taxes by converting to S corporation status right before they sell appreciated assets. As a result an S corporation can help the owner save money on corporate taxes.

Thats why as far as taxes go and certainly when stacked up against personal income tax corporation tax is a screaming delight. An S corporation that makes say 100000 in profits pays no income taxes on that profit. Forming an S-Corporation can help the shareholders save money on taxes but there are disadvantages as well.

For tax years beginning after December 31 2017 subject to a sunset at the end of 2025 section 199A of t he new law generally allow s an individual taxpayer and a trust or estate a deduction for 20 of the individuals domestic qualified business income from a partnership S corporation or sole proprietorship. A Special Tax Deduction for S Corp Owners. In fact not even all corporations file tax returns.

Eg if founders will be investing a significant amount of cash in a startup venture and VC funding is not imminent an S corporation may be very. Check with your accountant. If a shareholder has one-tenth of the total shares 220000 of the taxable income of the business must be included on his or her personal income tax return for the year.

This means that the corporation itself is not taxed on its profits. Each has unique federal tax requirements and practices. Its a great arrangement for most businesses.

Some smaller corporations are designated as an S corporation and pass their earnings on to their stockholders. The S corporation allows the owner to report the taxes on their personal tax return similar to an LLC or sole. The profits are passed onto the shareholders and are taxed as personal income much the way an LLC is taxed.