Have the right intentions. Restaurant business plans are divided into sections that describe all the aspects of your new business from your restaurant concept to your financials.

Running A Restaurant Franchising For Dummies Importados Mercado Livre

Educate employees about your products and concept.

Starting a restaurant for dummies. This is a must-have for anyone thinking of opening her own restaurant. The book covers all major aspects of running a restaurant from writing the all important restaurant business plan to getting word out through marketing and advertising. You need to develop the right attitude promote the restaurant keep an eye on the competition and communicate with your customers.

If you love food and want to start your own small business youve probably done some research into how to open a restaurantAfter all launching a restaurant is one of the most common routes to entrepreneurship in the United States. If you already own a restaurant inside youll find. This site is a collection of resources and tools for starting a restaurant including a restaurant industry report sample restaurant business plans and a.

Running a restaurant is a tough business. Starting a restaurant for dummies requires that every little detail is taken into consideration. If you already own a restaurant inside youll find.

Starting a restaurant like any new business requires a solid business plan. If you want to make it as a restaurant owner you have to love what you do Kim Strengari says. Starting Running a Restaurant For Dummies will offer aspiring restaurateurs advice and guidance on this highly competitive industry from attracting investors to your cause to developing a food and beverages menu to interior design and pricing issues to help you keep your business venture afloat and enjoyable at the same time.

Read Starting And Running A Restaurant For Dummies For Dummies Uploaded By Denise Robins a restaurant is a business like any other which means that it has to be managed well to survive these tips can help play up your strengths and make them matter to your diners analyze your competition determine their deficiencies and. There are several steps you must take in order to begin the venture and to have a successful opening. The authors offer aspiring restaurateurs advic.

Starting Running a Restaurant For Dummies will offer aspiring restaurateurs advice and guidance on this highly competitive industry from attracting investors to your cause to developing a food and beverages menu to interior design and pricing issues to help you keep your business venture afloat and enjoyable at the same time. Here are some top tips. Catering offers a lot the same creative freedoms as running a restaurant at a fraction of the cost.

Therefore you have to consider having to come up with a unique concept hiring the right staff or workforce promoting the business designing the menu giving your customers exceptional services while positioning yourself to compete favorably with your competition. Starting Running a Restaurant For Dummies will offer aspiring restaurateurs advice and guidance on this highly competitive industry from attracting investors to your cause to developing a food and beverages menu to interior design and pricing issues to help you keep your business venture afloat and enjoyable at the same time. Running a catering business may be the perfect job for you if you enjoy entertaining and cooking.

Running a Restaurant for Dummies is written in a straightforward funny style thats both engaging and informative. Best Book Starting And Running A Restaurant For Dummies For Dummies Uploaded By Penny Jordan choose a great restaurant location start and run a successful restaurant if youre an aspiring restaurateur running a restaurant for dummies covers every aspect of getting started from setting up a business plan to designing a menu and. If you already own a restaurant inside youll find.

Trying out catering as a part-time or full-time job can help you decide if you. Coming up with the concept designing the menu hiring the right staff and running it from day to day are all difficult and time consuming. And to get and keep a great team on side you need to make your restaurant a really great place for them to work.

Starting Running a Restaurant For Dummies will offer aspiring restaurateurs advice and guidance on this highly competitive industry from attracting investors to your cause to developing a food and beverages menu to interior design and pricing issues to help you keep your business venture afloat and enjoyable at the same time. This is the step that may become a stumbling block for those unfamiliar with business plans and how they are written. Praise praise praise them.

Months and months of careful planning are essential. Tips for starting a successful restaurant 1. According to the National Restaurant Association restaurant workers make up 10 of the United States workforce.

Starting Running a Restaurant For Dummies covers. Advertising for a new catering business is easy with the use of social media and photo-based sites like Instagram. Let them taste the food on a regular basis.

Starting Running a Restaurant for Dummies book. Read reviews from worlds largest community for readers. This is meant to provide the needed guidance.

Starting Running a Restaurant For Dummies will offer aspiring restaurateurs advice and guidance on this highly competitive industry from attracting investors to your cause to developing a food and beverages menu to interior design and pricing issues to help you keep your business venture afloat and enjoyable at the same time. While she knew a restaurant was the right path for her she had to work nights cleaning office buildings to make ends meet when she first opened her restaurant. If you already own a restaurant inside youll find unbeatable tips and advice to keep bringing in those customers.

Last Version Starting And Running A Restaurant For Dummies For Dummies Uploaded By James Patterson choose a great restaurant location start and run a successful restaurant if youre an aspiring restaurateur running a restaurant for dummies covers every aspect of getting started from setting up a business plan to designing a. Basics of the restaurant business Researching the marketplace and deciding what kind of restaurant to run Writing a business plan and finding financing Choosing a location Legalities Composing a menu Setting up and hiring staff Buying and managing supplies Marketing your restaurant Health and safety. If you already own a restaurant inside youll find.

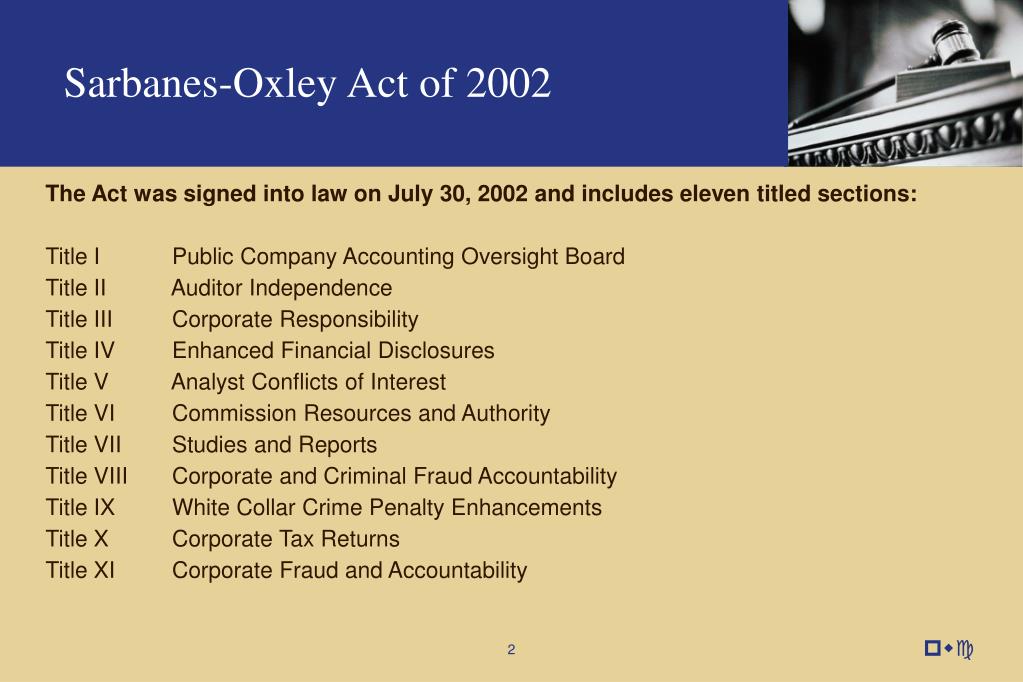

Passed in response to the corporate and accounting scandals of Enron Tyco and others of 2001 and 2002 the laws purpose is to rebuild public trust in Americas corporate sector. SarbanesOxley The SarbanesOxley Act of 2002 is a law that was passed as a result of several corporate scandals involving falsification of financial records of public companies.

Ppt The Sarbanes Oxley Act Powerpoint Presentation Free Download Id 5514640

For example Section 807 creates a new securities fraud provision that appears in the criminal code.

Sarbanes-oxley act of 2002 for dummies. Advanced Auditing and Professional Ethics. There was a total failure by everyone a complete breakdown in the system in all the checks and balances. As the Los Angeles Times reported January 26 2002 less than two months after Enron filed for bankruptcy.

While this legislation does not apply to private firms it is important information for entrepreneurs to know because it dictates how all public companies are required to disclose financial information and highlights some of the faulty accounting and dishonest business practices which contributed to. 745 enacted July 30 2002 also known as the Public Company Accounting Reform and Investor Protection Act in the Senate and Corporate and Auditing Accountability Responsibility and Transparency Act in the House and more commonly called SarbanesOxley or SOX is a United States federal law that set new or. To achieve this Sarbanes-Oxley SOX mandated greater auditor independence increased corporate governance and documentation of corporate internal controls and enhanced financial disclosures.

Sarbanes-Oxley has been called by many the most far-reaching US. Sarbanes-Oxley also known as SOX is a federal l. The Sarbanes-Oxley Act of 2002 is a US.

Often known as SarBox or just SOX this law has had a significant effect on security policy and security controls in US. The Sarbanes-Oxley Act SOX provides a legal model for running corporations of all sizes regardless of whether theyre publicly traded and technically subject to SOX. The best legal minds agree that good liability-limiting governance after SOX requires corporations to do the following.

This provision makes it a crime. Its purpose is to review legislative audit requirements and to protect investors by improving the accuracy and reliability of corporate disclosures. The Sarbanes-Oxley Act was not just a response to Enron despite the failures its collapse exposed.

The Sarbanes-Oxley Act commonly called SOX reformed corporate financial reporting and the accounting profession. The SarbanesOxley Act of 2002 PubL. It created the Public Company Accounting Oversight Board to oversee the accounting industry.

The Sarbanes-Oxley Act The Sarbanes-Oxley Act of 2002 is mandatory. As such the Act is widely considered to contain some of the most dramatic changes to federal securities laws since the 1930s. This video discusses the main effects of the Sarbanes-Oxley Act on companies executives and audit firms.

The US Sarbanes-Oxley Act was passed in the wake of a myriad of corporate scandals. Securities legislation in years. Chartered AccountancyThe Sarbanes Oxley Act 2002 Introduction Major Provisions Of Sarbanes Oxley Act Part.

Auditing departments typically first have a comprehensive external audit by a Sarbanes-Oxley compliance specialist performed to identify areas of risk. The Sarbanes-Oxley Act of 2002 cracks down on corporate fraud. 107204 text 116 Stat.

The Sarbanes-Oxley Act was signed into law on July 30 2002 in response to corporate scandals. The Sarbanes-Oxley Act was signed into law on 30 July 2002 by President Bush. The Act is designed to oversee the financial reporting landscape for finance professionals.

Evaluate your board members. Sarbanes Oxley Act - Summary of Key Provisions. Its imperative that companies are accountable to a solid checks and balances system.

ALL organizations large and small MUST comply. The Sarbanes-Oxley Act also known as SOX was signed into law on July 30 2002. Now all companies required to file periodic reports with the Securities and Exchange Commission SEC have new duties for reporting and corporate.

Help for Small Businesses - The Sarbanes-Oxley Act was passed in 2002 after a number of corporate scandals including Tyco International WorldCom and most notably Enron. Revelations that corporate executives filed misleading financial statements and of cozy relationships between accounting firms and. Congress passed SOX in 2002 after a string of corporate scandals most prominently at Enron and WorldCom shocked the public and rattled markets.

Many thousands of companies face the task of ensuring their accounting operations are in compliance with the Sarbanes Oxley Act. Sarbanes-Oxley Sarbanes-Oxley Act of 2002 Public Company Accounting Reform and Investor Protection Act of 2002 atau kadang disingkat SOx atau Sarbox adalah hukum federal Amerika Serikat yang ditetapkan pada 30 Juli 2002 sebagai tanggapan terhadap sejumlah skandal akuntansi perusahaan besar yang termasuk di antaranya melibatkan Enron Tyco International Adelphia Peregrine Systems dan WorldCom. The Sarbanes-Oxley Act of 2002 came in the wake of some of the nations largest financial scandals including the bankruptcies of Enron WorldCom and Tyco.

It provides information and identifies resources to help ensure successful audit and management. This website is intended to assist and guide. It banned company loans to executives and gave job protection to whistleblowers.

For instance companies such as Enron WorldCom and Tyco covered up or misrepresented a variety of questionable transactions resulting in huge losses to stakeholders and a crisis in investor confidence. The Act strengthens the independence and financial literacy of corporate boards. Federal legislation that seeks to ensure that companies with public shareholders accurately represent their financial state so that investors better understand risks.

To understand which parts of SOX apply to your company you need to understand what type of investments are considered securities and which types of issuers are subject to or exempt from SOX. What these scandals had in common was skewed reporting of selected financial transactions.

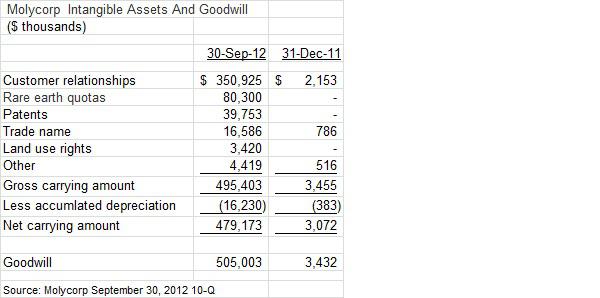

There are two scenarios under which a fixed asset may be written off. The amortization of intangibles involves the consistent reduction in the recorded value of an intangible asset over its projected life.

Molycorp 4 Reasons To Take That 1b Intangible Asset Write Off Now Otcmkts Mcpiq Seeking Alpha

Therefore the accounting treatment for all research expenditure is to write it off to the profit and loss account as incurred.

Intangible assets write off. Intangible assets do not have physical substance. This is a common situation when a fixed asset is being scrapped because it is obsolete or no longer in use and there is no resale market for it. IAS 38 Intangible Assets outlines the accounting requirements for intangible assets which are non-monetary assets which are without physical substance and identifiable either being separable or arising from contractual or other legal rights.

You dont amortize indefinite life intangible assets. All intangible assets are not subject to amortization. Examples of intangible assets are.

What I am saying is that this isan allowable PL debit for CT purposes where a Corporate Intangible is involved so it is not ADDED BACK in the CT profit computation. IAS 38 Intangible Assets outlines the accounting requirements for intangible assets which are non-monetary assets which are without physical substance and identifiable either being separable or arising from contractual or other legal rights. The write-off which was described as a non-cash charge for the impairment of the Autonomy purchase included goodwill and intangible asset charges.

Some experts or authors believe that this writing off of assets is a form of disposal of the asset. This will reduce the net profit. Intangible assets meeting the relevant recognition criteria are initially measured at cost subsequently measured at cost or using the revaluation model and amortised on a systematic basis over their useful lives unless the asset has an indefinite.

As a result it is only tangible assets - physical things - that your business can depreciate for tax purposes. 197f1A applies to any loss that would be realized on the disposition of a Sec. It is everything with the exception of goodwill.

This transfers the book value of the asset to the designated expense account and the book value on the balance sheet is reduced to zero. Tangible assets lose value and depreciate over time intangible assets do not. 197 intangible asset that was acquired in a transaction with other Sec.

If a business creates an intangible asset it can write off the expenses from the process such as filing the patent application hiring a lawyer and paying other related costs. Only recognized intangible assets with finite useful lives are amortized. Amortization refers to the write-off of an asset over its expected period of use useful life.

Intangible assets meeting the relevant recognition criteria are initially measured at cost subsequently measured at cost or using the revaluation model and amortised on a systematic basis over their useful lives unless the asset has an indefinite. To dispose of an intangible asset go to the Intangible Assets tab click the Edit button for the asset disposed check Disposed intangible asset then enter the date of disposal. To eventually move the cost off the balance sheet test indefinite life intangibles at least annually for impairment which means the carrying cost of the intangible is no longer recoverable.

The general loss disallowance rule in Sec. As the asset has been effectively disposed ofwritten off all of the balance of the cost will be debited to the PL in the AP of write-off. Intangible assets are business assets that have no physical form.

197 intangible assets from the same acquisition. We do not know exactly how you recorded the software and patent development costs on your Balance Sheet or whether you amortized any of those development costs but if you have stopped selling the software have abandoned any further development or sale and the software programming is not saleable then you can write-off the remaining book value of the software and related intangibles as worthless assets. 197 intangible assets if at the time of the disposition the taxpayer retains one or more of the other Sec.

If the website does not generate income for the business then it will fail to meet the asset recognition criteria and the costs must be written off to profit or loss. A portion of an intangible assets cost is allocated to each accounting period in the economic useful life of the asset. This represents a significant departure from the approach generally adopted in.

Unlike a tangible asset. Most tangible assets that you would depreciate should have a value of more than 500. Please note that under FRS 102 intangible assets cannot have indefinite useful lives see Amortisation of intangible assets below.

Amortization is the systematic write-off of the cost of an intangible asset to expense. Development As a basic rule expenditure on development costs should be written off to the profit and. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset account and accumulated depreciation account are reduced.

To that end the legislation gives companies tax deductions for sums written off intangible assets in their accounts. The first situation arises when you are eliminating a fixed asset without receiving any payment in return. For instance the business eliminates fixed assets without receiving any payment in return.

However for the purposes of the FASB intangible asset does not refer to goodwill. Write off specifically refers to the removal or derecognition of the asset from the Fixed Assets register and Statement of Financial Position at Zero value. The FASB defines intangible assets as assets not including financial assets that lack physical substance In most transactions we might think of goodwill as such an intangible asset.

Due to the general complexities of the tax rules and guidelines for capital. The second class of intangibles goodwill is never amortized.