Income distributions are reported to beneficiaries and the IRS on Schedules K-1 Form 1041. Instead you may be able to.

However if trust and estate beneficiaries are entitled to receive the income the beneficiaries must pay the income tax rather than the trust or estate.

Irs form 1041 k 1. Form 1041 Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. Generally you must file the source credit form along with Form 3800 General Business Credit to claim the general business credits listed on Schedule K-1 Form 1041 codes C through Q and code Z. 1 2 2352 Reply.

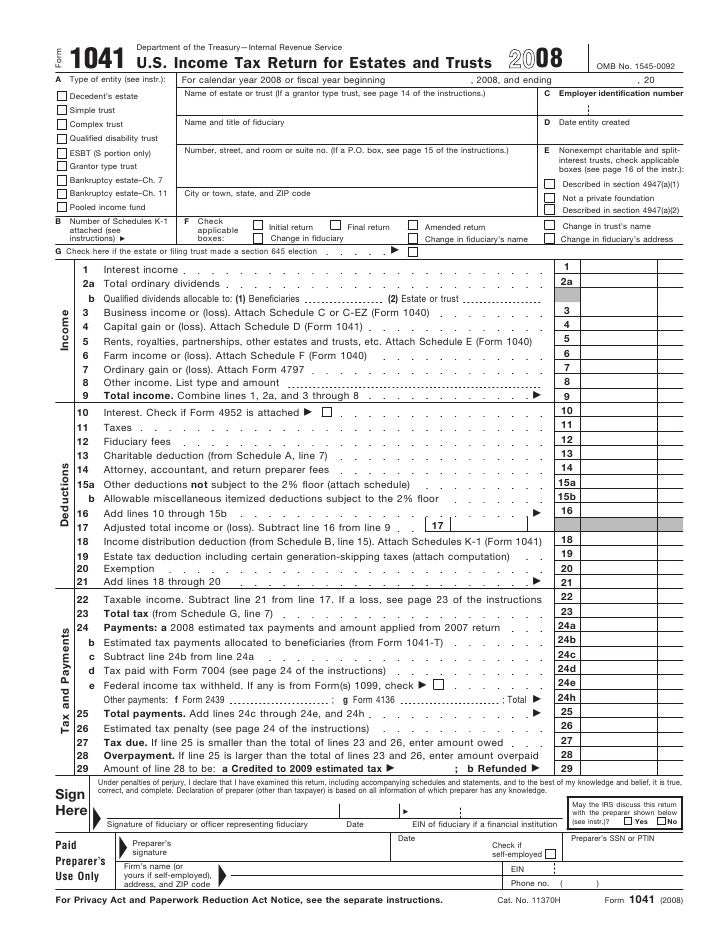

IRS Form 1041 is an income tax return filed by a decedents estate or living trust after their death. Schedule K-1 Form 1041 is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return Form 1041. 1545-0092 Part I Information About the Estate or Trust A Estates or trusts employer identification number B.

Its full name is Beneficiarys Share of Income Deductions Credits etc The estate or trust is responsible for filing Schedule K-1 for each listed beneficiary with the IRS. IRS Schedule K-1 Form 1041 is used to report a beneficiarys share of income deductions and credits from a trust or estate. However if your only source for the credits listed on Form 3800 Part III is from pass-through entities you may not be required to complete the source credit form.

Is an informational tax form that shows the beneficiarys share of an estate or trust. View solution in original post. Estates have to file an IRS Form 1041 if they as in their estate earn more than 600 per year.

The share may include income credits deductions and profits. Dont file Schedule K-1 with your individual taxes unless there is backup withholding reported in Box 13 Code B. Blank Schedule K-1 Form 1041 - This includes descriptions of each boxsection and explanations of where each item should be reported.

See back of form and instructions. If you do need to generate K-1s then you do need the social security tax ID numbers of the beneficiaries. Information Return Trust Accumulation of Charitable Amounts 0918 09052018 Form 1041-ES.

Form 1041 Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. 2020 12092020 Inst 1041 Schedule K-1 Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 2020 12112020 Form 1065 Schedule K-1 Partners Share of Income Deductions Credits etc. Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040.

This form shows the pass-through of tax responsibility from the estate or trust to the person or entity that benefits from it. After filing Form 1041 the fiduciary may provide a beneficiary a Schedule K-1 that reflects the beneficiarys share of income deductions credits and other items that the beneficiary will need to report on their individual tax return. Use Schedule K-1 to report a beneficiarys share of estatetrust income credits deductions etc on your Form 1040.

Schedule K-1 Form 1041 Explained. An estate or trust can generate income that must be reported on Form 1041 United States Income Tax Return for Estates and Trusts. Keep Schedule K-1 with your tax records.

Information about Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits etc including recent updates related forms and instructions on how to file. Final K-1 Amended K-1 661111 OMB No. Schedule K-1 Form 1041 Department of the Treasury Internal Revenue Service 2011 For calendar year 2011 or tax year beginning 2011 and ending 20 Beneficiarys Share of Income Deductions Credits etc.

Schedule K-1 Form 1041 Beneficiarys Share of Income Deductions Credits Etc. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019--10-JUL-2020. Net long-term capital gain.

Schedule K-1 Form 1041 is an official IRS form thats used to report a beneficiarys share of income deductions and credits from an estate or trust. It is also good practice to make the beneficiaries aware that they have no income tax liability on the distributions if the estate will pay all of the tax due. K-1 Form 1041 for a Beneficiary Filing Form 1040 or 1040-SR and the instructions for your income tax return.

Limitation on business losses for certain taxpayers repealed for 2018 2019 and 2020 --19-MAY-2020. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. 2020 12092020 Inst 1041 Schedule K-1 Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 2020 12112020 Form 1041-A.

If more time is needed to file the estate return apply for an. It reports income capital gains deductions and losses but its subject to somewhat different rules than those that apply to living individuals. The estate also has to generate Schedule K-1 forms for any beneficiaries of the estate.

If the due date. Schedule D line 5 4a. Estimated Income Tax for Estates and Trusts 2020 11202020 Form 1041-ES.

For calendar-year file on or before April 15 Form 1041 US. Form 1040 or 1040-SR line 2b 2a. For calendar year estates and trusts file Form 1041 and Schedules K-1 on or before April 15 of the following year.

For fiscal year file by the 15th day of the fourth month following the tax year close Form 1041. And if youre a beneficiary you also have to. Schedule K-1 Form 1041 is an official IRS form thats used to report a beneficiarys share of income deductions and credits from an estate or trust.

That means if a grandparent gives money to three children and nine grandchildren their estate will need to generate 12 unique Schedule K-1 forms. Form 1040 or 1040-SR line 3b 2b. Some items reported on your Schedule K-1 Form 1041 may need to be entered directly into a specific form instead of the K-1.

For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year. Level 15 June 4 2019 539 PM. Internal Revenue Service.

2020 01052021 Inst 1065 Schedule K-1 Instructions for Schedule K-1 Form 1065 Partners Share of. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1-- 29-JAN-2021. The fiduciary must file Schedule K-1 with the IRS for each beneficiary and provide each beneficiary with a copy.

Its similar to a return that an individual or business would file. If the tax year for an estate ends on June 30 2020you must file by October 15 2020. At the end of the year all income distributions made to beneficiaries must be reported on a Schedule K-1.

Form 1040 or 1040-SR line 3a 3. Net short-term capital gain.

Https Www Irs Gov Pub Irs Schema 1041 Mef Ats Scenario 1 Form 201041 Pdf

Form 1041 U S Income Tax Return For Estates And Trusts Form 1041

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

A 2020 Overview Of Irs Form 1041 Schedules

Https Www Irs Gov Pub Irs Prior I1041sk1 2016 Pdf

:max_bytes(150000):strip_icc()/Screenshot21-75ee5e68abbd4beba9ef63de3b239745.png)