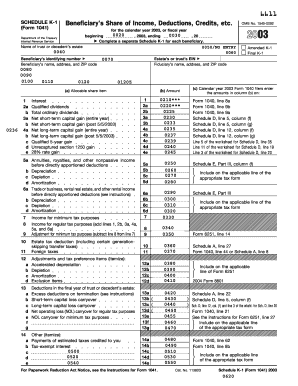

Blank Schedule K-1 Form 1041 - This includes descriptions of each boxsection and explanations of where each item should be reported. However if your only source for the credits listed on Form 3800 Part III is from pass-through entities you may not be required to complete the source credit form.

Its full name is Beneficiarys Share of Income Deductions Credits etc The estate or trust is responsible for filing Schedule K-1 for each listed beneficiary with the IRS.

K 1 form 1041. Schedule K-1 Form 1041 is an official IRS form thatâ s used to report a beneficiaryâ s share of income deductions and credits from an estate or trust. Instead you may be able to. Form 1040 or 1040-SR line 3b 2b.

Net short-term capital gain. 2020 12092020 Inst 1041 Schedule K-1 Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 2020 12112020 Form 1041-A. Nonexempt charitable and split-interest trusts check applicable boxes.

Get And Sign Form 1041 Schedule K 1 2020-2021. At the end of the year all income distributions made to beneficiaries must be reported on a Schedule K-1. Schedule D line 12 4b.

1545-0092 Part I Information About the Estate or Trust A Estates or trusts employer identification number B. Schedule K-1 Form 1041 is an official IRS form thatâ s used to report a beneficiaryâ s share of income deductions and credits from an estate or trust. E Net investment income Form 4952 line 4a F Gross farm and fishing income G Foreign trading gross receipts IRC 942 a See the Instructions for Form 8873 Form 6251 line 2f investment income or deductions Form 8960 line 7 also see the beneficiary s instructions I Section 199A information Note If you are a beneficiary who does not file a Form 1040 or.

Itâ s full name is â Beneficiaryâ s Share of Income Deductions Credits etcâ The estate or trust is responsible for filing Schedule K-1 for each listed beneficiary with the IRS. Itâ s full name is â Beneficiaryâ s Share of Income Deductions Credits etcâ The estate or trust is responsible for filing Schedule K-1 for each listed beneficiary with the IRS. If not a private foundation.

Generally you must file the source credit form along with Form 3800 General Business Credit to claim the general business credits listed on Schedule K-1 Form 1041 codes C through Q and code Z. Amended return Net operating. K-1 Form 1041 for a Beneficiary Filing Form 1040 or 1040-SR and the instructions for your income tax return.

An estate or trust can generate income that must be reported on Form 1041 United States Income Tax Return for Estates and Trusts. Some items reported on your Schedule K-1 Form 1041 may need to be entered directly into a specific form instead of the K-1. Schedule D line 5 4a.

See back of form and instructions. Schedule K-1 Form 1041 Explained. Improve your productivity with powerful service.

Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040. Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019--10-JUL-2020. About Publication 559 Survivors Executors and Administrators.

2020 01052021 Inst 1065 Schedule K-1 Instructions for Schedule K-1 Form 1065 Partners Share of. B Number of Schedules K-1 attached see instructions C Employer identification number D. Schedule K-1 Form 1041 is an official IRS form thats used to report a beneficiarys share of income deductions and credits from an estate or trust.

Estimated Income Tax for Estates and Trusts 2020 11202020 Form 1041-ES. It reports income capital gains deductions and losses but its subject to somewhat different rules than those that apply to living individuals. Limitation on business losses for certain taxpayers repealed for 2018 2019 and 2020 --19-MAY-2020.

2020 12092020 Inst 1041 Schedule K-1 Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 2020 12112020 Form 1065 Schedule K-1 Partners Share of Income Deductions Credits etc. Date entity created. Form 1041 Schedule K-1 Beneficiarys Share of Income Deductions Credits etc.

Form 1040 or 1040-SR line 3a 3. And if youâ re a beneficiary you also have to receive. After filing Form 1041 the fiduciary may provide a beneficiary a Schedule K-1 that reflects the beneficiarys share of income deductions credits and other items that the beneficiary will need to report on their individual tax return.

About Publication 535 Business Expenses. An estate or trusts income retains its character and so beneficiaries must be informed of this character. Net long-term capital gain.

Complete forms electronically using PDF or Word format. And if youâ re a beneficiary you also have to receive. Other Items You May Find Useful.

Form 1041 Schedule K-1 Beneficiarys Share of Income Deductions Credits etc. And if youre a. IRS Form 1041 is an income tax return filed by a decedents estate or living trust after their death.

Form 1040 or 1040-SR line 2b 2a. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1-- 29-JAN-2021. Instructions for Schedule K-1 Form 1041 for a Beneficiary Filing Form 1040 Print Version PDF Recent Developments.

Schedule K-1 Form 1041 Department of the Treasury Internal Revenue Service 2011 For calendar year 2011 or tax year beginning 2011 and ending 20 Beneficiarys Share of Income Deductions Credits etc. However if trust and estate beneficiaries are entitled to receive the income the beneficiaries must pay the income tax rather than the trust or estate. All Schedule K-1 Form 1041 Revisions.

Make them reusable by creating templates add and complete fillable fields. About Publication 514 Foreign Tax Credit for Individuals. Schedule K-1 Form 1041 is an official IRS form thats used to report a beneficiarys share of income deductions and credits from an estate or trust.

Schedule K-1 Form 1041 is a source document that is prepared by the fiduciary to an estate or trust as part of the filing of their tax return Form 1041. Final K-1 Amended K-1 661111 OMB No. None at this time.

Approve forms by using a lawful digital signature and share them via email fax or print them out. When there is one income beneficiary the total amount of the. Information Return Trust Accumulation of Charitable Amounts 0918 09052018 Form 1041-ES.

Its similar to a return that an individual or business would file. The Schedule K-1 Form 1041 gives the beneficiary the specific allocation between all items of income allowing easy transfer from the K-1 to the beneficiarys Form 1040. Save files on your laptop or mobile device.

Schedule K-1 Form 1041 Explained.

The Schedule K 1 Form Explained The Motley Fool

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Internal Revenue Service Schedule K 1 Form 1041

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Fillable Online Irs Line Codes For Form 1041 Schedule K 1 Taxsoftware Com Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/Screenshot21-75ee5e68abbd4beba9ef63de3b239745.png)